Enron rose from a modest natural gas company in 1985 to America’s seventh-largest corporation through aggressive trading and financial manipulation. You’d find their culture celebrated competition while enabling accounting tricks that concealed massive debt.

Despite warning signs, executives maintained the illusion until 2001, when Enron suddenly collapsed into bankruptcy, costing 25,000 jobs and billions in investor losses. The aftermath transformed corporate governance regulations and continues to serve as the ultimate business ethics cautionary tale.

Image: Dewliter, 1400SmithDowntown, CC BY-SA 4.0

The Birth of an Energy Giant (1985-1992)

When Houston Natural Gas and InterNorth merged in 1985, few could have predicted the meteoric rise—and spectacular fall—that would follow. The newly formed company, Enron, quickly positioned itself as a dominant force in North America’s natural gas industry.

You’ve probably heard how deregulation created perfect conditions for Enron’s ambitious expansion. By 1992, they’d become North America’s largest natural gas seller.

The company’s leadership wasn’t satisfied with traditional energy markets, though. They hired consulting firm McKinsey to reshape their business strategy, leading to Enron’s revolutionary energy derivatives trading division.

This strategic pivot transformed Enron’s financial path. Their revenue surged from $2 billion in 1990 to an impressive $7 billion by 1996, showcasing how their aggressive trading approach initially delivered remarkable results.

The company’s development model was drastically different from Texas Instruments, which had grown from a small oil exploration firm into a semiconductor giant through integrated circuit technology and legitimate innovations.

Crafting a Culture of Competition and Innovation

While Enron’s business strategy evolved dramatically, its corporate culture underwent an equally significant transformation. You’d witness Enron aggressively recruiting top MBA graduates, offering lavish bonuses and perks to cultivate an atmosphere of innovation and risk-taking.

Under Jeffrey Skilling’s leadership, the corporate structure institutionalized internal competition through the notorious Performance Review Committee. This system ranked employees ruthlessly, prioritizing those who generated immediate profits for the trading business over long-term potential.

As Enron’s accounting practices grew increasingly opaque, the company’s financial statements became more secretive. This culture of win-at-all-costs gradually eroded proper risk management protocols. What began as an attempt to foster innovation ultimately created a toxic environment where employees competed so fiercely they overlooked ethical concerns—setting the stage for the company’s spectacular downfall.

Unlike Criswell College’s commitment to biblical inerrancy that shapes all aspects of its educational approach, Enron lacked ethical foundations to guide its corporate practices.

Financial Engineering: The Smoke and Mirrors

The architecture of Enron’s downfall rested on a foundation of financial deceit. Behind the corporate image, Andrew Fastow orchestrated an elaborate scheme using special purpose entities (LJM1 and LJM2) to hide mounting debt and inflate Enron’s stock price.

You’d be shocked by the magnitude of their accounting manipulations:

- Off-the-books partnerships called Raptors concealed $1.2 billion in assets that later suffered catastrophic losses

- Mark-to-market accounting recorded estimated future profits as current income

- Loan transactions were misclassified as sales to meet quarterly targets

- Financial instruments deliberately bypassed standard accounting norms

This financial manipulation violated basic corporate principles by understating liabilities, overstating equity, and misrepresenting performance. The illusion of success temporarily held, but couldn’t prevent the collapse.

Much like Captain Lucas’s success at Spindletop transformed the American energy landscape, Enron’s failure dramatically reshaped corporate governance and accounting oversight in the U.S.

Warning Signs Ignored: Red Flags Before the Fall

Repeatedly, glaring warning signs of Enron’s impending collapse were ignored by those who should have intervened. Arthur Andersen LLP, once a respected auditing firm, failed to challenge Skilling and Fastow’s complex financial schemes that hid mounting debt. The Securities and Exchange Commission noticed irregularities but took no meaningful action as Enron’s stock price continued its artificial climb.

Kenneth Lay presided over a board that rubber-stamped questionable accounting practices rather than exercising real oversight. Wall Street analysts kept recommending Enron stock despite growing financial red flags.

Everyone with authority to intervene—from internal auditors to regulators—chose willful blindness over accountability. The company’s elaborate house of cards remained standing only because those tasked with inspecting its foundation refused to look closely enough.

The 2001 Collapse: Bankruptcy and Public Shock

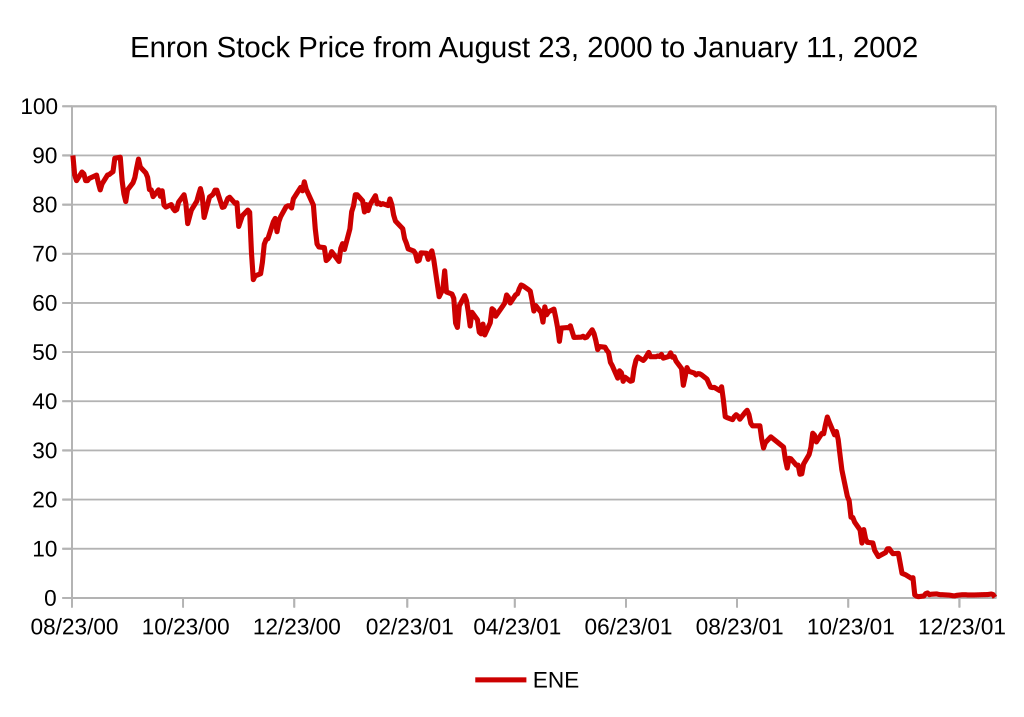

Image: User:Nehrams2020 (original), User:0xF8E8 (SVG), EnronStockPriceAugust2000toJanuary2001, CC BY-SA 3.0

After months of financial manipulation and deception, Enron’s house of cards collapsed in December 2001 when the company filed for Chapter 11 bankruptcy protection with over $63 billion in assets—making it one of the largest corporate failures in U.S. history.

The fall of Enron shocked the public as:

- Enron’s stock price plunged from $90 to under $1

- Over 25,000 employees lost their jobs and $2 billion in retirement savings

- Enron’s leadership faced criminal charges for fraud and conspiracy

- Arthur Andersen collapsed, putting another 28,000 out of work

The scandal exposed deep flaws in financial transparency, prompting new legislation like the Sarbanes-Oxley Act of 2002, aimed at preventing similar corporate meltdowns.

Executive Accountability and Legal Consequences

Following Enron’s collapse, legal efforts moved swiftly to hold key figures accountable. Founder Kenneth Lay and former CEO Jeffrey Skilling were convicted on charges including fraud and conspiracy, while CFO Andrew Fastow pled guilty and served six years for orchestrating fraudulent accounting practices.

The scandal’s reach extended beyond executives. Auditor Arthur Andersen collapsed after being convicted of obstruction of justice for destroying Enron-related documents. You’ll recognize this case’s long shadow in Sarbanes-Oxley, which established tougher penalties for financial misconduct.

Enron’s implosion fundamentally changed how corporate governance is viewed. It proved that transparency and accountability aren’t just buzzwords—they’re essential safeguards. These reforms were designed to ensure that executives can’t hide behind complex financial games.

Regulatory Reform and Corporate Governance Legacy

When Enron’s collapse shocked global markets in 2001, it triggered the most sweeping regulatory reforms since the Great Depression. The Sarbanes-Oxley Act directly addressed the governance failures behind the scandal, transforming how public companies function.

You’ll see four critical changes that reshaped American business:

- Stricter separation between auditing and consulting roles for accounting firms

- CEO and CFO certifications affirming financial reporting accuracy

- Enhanced whistleblower protections to safeguard employee disclosures

- New rules targeting off-balance-sheet maneuvers and financial trickery

These reforms didn’t just shift the rules—they fundamentally changed corporate America’s relationship with accountability. The legacy of Enron’s collapse continues to influence how companies operate and disclose financial health today.