Texas is the second-largest state in the USA in terms of both land and population. It became the 28th state of the union in 1845. The state extends to about 100 miles from North to South and around the same from East to West. It gained its independence from Mexico in 1836, after which it got its nickname “The Lone Star State,” paying tribute to the unity with which Texans fought for freedom.

Although Texas is known for its “cowboy” culture, which depicts raw force and lawlessness, it is also a land of historical movements, vast agriculture, and huge natural resource industry. Texas is usually divided into East and West divisions based on the climate and the produce they make. East Texas is known as a wetland and is famous for producing cotton, while West Texas is dry land – perfect for cattle ranching.

A Brief History of Texas

The Spanish colonials took over Texas by 1519 AD. Up until the 18th century, Texas remained safe from further attacks and invasions. It was after the founding of San Antonio missionaries that made the Mexicans rebel against Spaniards. They won their liberation in 1821, and Texas became a part of Mexico.

The Mexicans allowed US citizens to settle and claim land in Texas. As more people from the US followed, the Mexican government freaked out about losing control over people, so they changed the laws and ended slavery. None of this was in accordance with the Texas culture.

Stephen Austin, the first settler, tried to persuade the Spanish government to be lenient with the laws, but instead, he was arrested and detained. The unrest started to throughout Texas. By 1835, Texas Revolution started, and Mexicans were defeated on several fronts. Finally, in 1836, Texans found their freedom, and Sam Houston was elected president. However, the Texas Republic was short-lived as it could not defend itself from further foreign invasions. In 1845, Texas formed a union with the US and formally became a state.

Modern Day Texas – Urban vs. Countryside

Texas is a sweet balance of urban and rural lifestyle with a unique tale to tell. Due to its vast lands, properties are privately owned, but only 1% of the total population actually live there. The ranches and farms are owned by people who prefer to live in developed cities.

Rural towns in Texas are the ones with the purest culture and way of living. Generally, Texas is affordable by nature for buying property and even start a family. The Balcones Escarpment is a big crack in the earth that separates the Rocky Mountains from the lowlands. The part of Texas, which comprises small rural towns, is known as Hill Country. It takes less than 30 minutes to get out of Austin to enjoy the scenic beauty of peach orchids and blossoms. In small towns like Alamo, where median household income is $39,275, and median home value is $70,600, it is relatively easy to get a job and raise enough money to buy a decent house.

Five of the cities in Texas – Dallas, Houston, Austin, San Antonio, and Fort Worth are among the USA’s fastest-growing cities. The unconventional oil and gas resources made Texas a rich state, which means there are far more new opportunities for people. Hordes of people move to these cities in search of such opportunities. Texas offers jobs for university graduates with decent wages, unlike other states that demand higher experiences. Due to lenient property laws, Texas is way cheaper than the rest of the states. Its paycheck is considered to be the most effective in Houston.

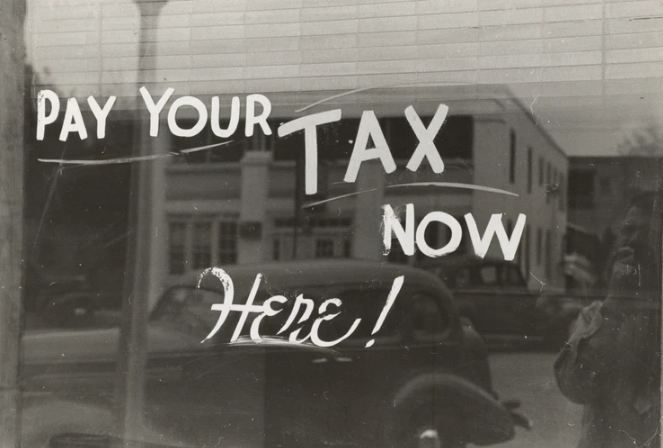

Property Tax in Texas

Texas has property taxes that are collected by local governments. These taxes in Texas are the seventh highest in the US. A property is considered to be anything that is used for earnings. For example, a car can be a piece of property if it is a primary source of income. Driving to and from work is not a part of tax appraisals. These taxes are the main source of collections for local governments to spend on public service. Schools, roads, parks and recreational places, and other services are maintained with such taxes. There are about 4,000 entities that can collect property taxes, including every city, county, and school district.

Property Tax Assessment

A property tax assessment is an estimation of the market value of an estate or a tangible property, which is done by local governments annually to calculate the tax everyone owes to the government. Each year, this calculation may vary depending on the current market rates.

Citizens have a right to appeal to the local law if their taxes seem way off. This may be done within a short time as some regions allow appeals within a time range. Commoners may expect that the tax bills will increase, especially if it is calculated once a year.

There are two types of property tax assessments:

The Replacement Method

This is calculated by estimating a property’s cost by replacing it with another. This includes the cost of labor and materials as well. Depreciation is deducted fairly, and the original price of the land is added to the amount.

The Sale Comparison Method

This method is based on the comparison between similar properties. If one property has an extra feature that the other property of the same type lacks, then by default, it will have more value than the other.

Properties in Texas are calculated based on the total property value and the total revenue need. Taxes are levied as a percentage of each home’s appraised value. If someone has a tax rate of 1.5% and their home value is $100,000, they will owe a property tax of $1500 annually.

Following is a brief guide on property taxes that the residents of the biggest counties of Texas pay:

- Harris County

This County is famous for its suburban cities like Houston. It is quite natural to have higher property tax rates compared to the rest. The tax rate here is significantly higher nation wise as well. The average tax rate here is 2.03%. Most of the high tax rates are levied by school districts, which are around 1.137%.

- Dallas County

The property tax rates in this county are relatively lower than Harris County but higher than the nation’s rate. An average household gives approximately 1.93% of their home value, most of which goes to schools.

- Tarrant County

Fort Worth and Arlington are the big cities in this county. The average tax rate here is 2.10%, but Fort Worth pays a bit higher than the rest. Fort Worth pays a total of 2.36%, while Arlington pays 2.244%.

- El Paso County

Famous for the cowboy culture, this county lies with Mexico in the west of Texas. The average property tax rate is 2.24%, but the home value is actually less here. This means that the residents pay more than the rest of the US.

- Hidalgo County

This county resides to the south of Texas. The median tax payment here is about $1,722 or 2.05%, which is the seventh-highest tax rate in the state.

- Collin County

This is the sixth most populous county of Texas. Like many others, it levies tax amid school districts. Plano Independent School district is at 1.32% tax rate while Frisco Independent is at 1.31%.

- Fort Bend County

Fort Bend is found to be among the highest taxpayer counties in the state. It levies an average of $5,563 on an average income with an effective tax rate of 2.22%. This makes it more than double of national averages.

- Denton County

Denton sits north of Dallas and Fort Worth. An average home value in this state is $255,300, while a regular citizen pays $4,836 in tax. The property tax rate, including school districts, goes up to 2.223%.

- Travis County

The state capital of Austin lies in this county. Although the city is quite developed and urban, it yields a total of 1.1027% tax rate, including school districts.

- Bexar County

This is the second-largest county in Texas that includes cities like San Antonio, which are not on the higher side of tax rates (2.61%). On a home value of $152,400, a citizen is supposed to pay $2,996 in taxes.

For more information, click here.

Texas Property Tax Exemption

The state of Texas allows exemption from the usual tax rates if certain conditions are met. Citizens are allowed to appeal their taxes. Some of the major tax exemption programs are:

1. Basic Homestead Exemption

The residents of Texas can be exempted $25,000 in their home’s appraisals. Also, Texas Code allows school districts for 20% exemption, but that cannot be less than $5000. For that, you need to submit an Application for Residential Homestead Exemption.

2. Exemption for Senior and Disabled

Citizens who are more than 65 years old or have a disability can be exempted for taxes up to $10,000. From school districts, they are exempted for less than $3000. This is in reference to Texas State Code.

3. Disabled Veterans

People who get disabled during service to the state are exempted for up to $12,000. The exemption depends on the degree of disability and age of the veteran. If someone is 75% disabled and is above age 65, they can get the maximum exemption of $12,000.

4. Spouse or Children of Deceased/Disabled Veteran

A disabled veteran’s spouse receives the same amount of exemption as the veteran themselves. This goes for the deceased veteran’s children as well.

Texas – An Emerging Economy

Some analysts argued about the future of Texas due to its dynamic and unrestful past. They used to say that its population will hardly ever reach a million. Now, Texas is one of the highest producing states in the US. The increase in population gave rise to affordable yet comfortable living. The taxes paid by the citizens, though some are high, add up to the nation’s progress.