Understanding the minimum car insurance requirements is essential to staying legal on the road in the Lone Star State. Texas law mandates that you carry at least $30,000/$60,000 in bodily injury liability and $25,000 in property damage coverage. You’ll also need uninsured/underinsured motorist protection at these same limits, plus $2,500 in personal injury protection per person.

Even if you don’t own a vehicle, you can protect yourself with non owner car insurance when driving rental cars or borrowing vehicles. While collision and broad coverage aren’t required by law, your lender may require them for financed vehicles. Many insurers now offer telematics-based insurance programs that track your driving habits to potentially lower your rates while maintaining these required coverages.

Similar to Texas energy deregulation policies, consumers have the freedom to shop around and compare different insurance providers to find the best rates and coverage options for their needs.

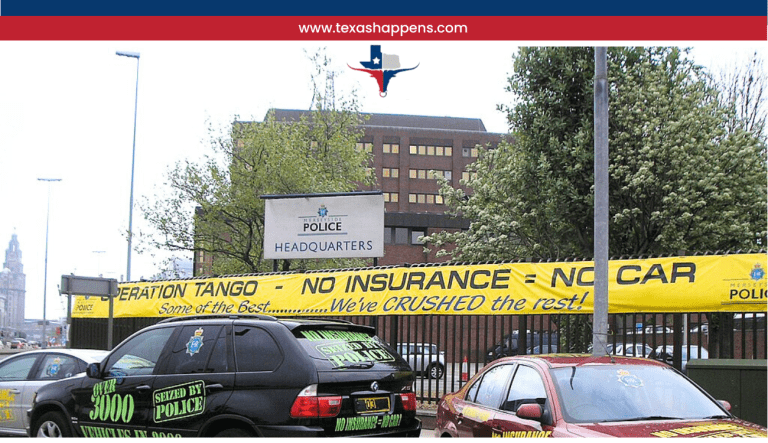

Image: Nick-D, Uninsured cars seized by police in Liverpool, CC BY-SA 3.0

Comparing Major Insurance Companies in Texas

View this post on Instagram

Several major insurance providers stand out in Texas’s competitive auto insurance market, including State Farm, Geico, Progressive, and Allstate. Each company offers unique advantages, and you’ll want to examine their coverage options carefully to find the best fit for your needs.

State Farm excels in customer loyalty programs, offering significant discounts for long-term policyholders. Geico typically provides competitive rates and easy insurance policy adjustments through their mobile app. Progressive stands out with their Name Your Price tool and snapshot program, which rewards safe driving habits. Allstate offers extensive local agent support throughout Texas and accident forgiveness options.

When comparing these providers, you’ll need to inspect factors beyond just price, such as claims handling, customer service ratings, and available discounts. Each company’s strengths can affect your overall insurance experience. Similar to how Blue Cross Blue Shield dominates the health insurance market in Texas with a 24.5% share, these auto insurance providers compete for market leadership through diverse coverage options.

Factors That Impact Texas Auto Insurance Rates

Understanding how insurers calculate your rates will help you make informed decisions when choosing from Texas’s major providers. Your driving record profoundly influences premiums, with a clean history leading to lower costs. Demographic trends play a pivotal role, as your age directly impacts rates – both younger and older drivers typically face higher premiums due to increased risk factors.

Your location and usage patterns affect costs too, with urban areas like Houston and Dallas commanding higher rates than rural regions. Additionally, insurers consider your credit score when determining premiums, while your choice of vehicle matters considerably. If you’re driving a sports car or luxury vehicle, you’ll likely pay more for coverage compared to a standard sedan or economy car. Poor credit scores can increase Texas auto insurance rates by up to 76% above the state average.

Finding the Most Affordable Car Insurance in Texas

Looking for affordable car insurance in Texas doesn’t mean you’ll have to sacrifice quality coverage. You’ll find some of the nation’s leading insurers offering competitive rates, with GEICO providing full coverage at around $1,260 annually and State Farm offering attractive rates for young drivers under 25.

When getting quotes from multiple insurers, you’ll want to evaluate USAA if you’re military-affiliated, as they offer the lowest average premiums at $980 per year. Progressive’s Name Your Price tool can help you find coverage that fits your budget while analyzing coverage levels that meet your needs.

If you maintain good credit and a clean driving record, you can expect to pay around $1,100 annually for full coverage insurance, making Texas car insurance quite reasonable with the right provider.

Each provider offers distinct advantages customized to different driver needs. The state’s favorable tax climate makes Texas an attractive location for insurance companies to establish and maintain competitive rates.

Special Discounts and Programs Available to Texas Drivers

View this post on Instagram

Beyond finding the best base rates, savvy Texas drivers can access significant savings through special discounts and programs. Liberty Mutual’s and Geico’s telematics programs, DriveEasy and DriveEasy respectively, can help you save up to 30% on your premiums through driver monitoring. Military members can benefit from USAA’s generous discounts, offering up to 15% off for on-base stationed personnel and 60% off for deployment vehicle storage.

You’ll find bundling opportunities with State Farm when you combine auto insurance with other policies, along with additional discounts for completing defensive driving courses. Travelers offers a unique Deductible Fund program where you can reduce your deductible by $100 annually for a $30 fee. Federal employees can also secure special rates through Geico’s targeted discount programs.

Military and Veteran Insurance Options in Texas

When it comes to protecting military personnel and veterans on the road, USAA stands out as the premier insurance provider in the Lone Star State. You’ll find discounted coverage for military members that includes unique benefits like vehicle storage coverage when you’re stationed on base and specialized insurance policies for overseas personnel.

If you’re actively serving, you’ll appreciate USAA’s pay-as-you-drive options and international coverage that transfers smoothly during deployments. The company also looks after your family with competitive rates for teen drivers and special discounts when they move to their own policies.

With auto loan rates starting at 5.29% for newer vehicles and an additional 0.25% discount for automatic payments, USAA delivers thorough financial solutions backed by outstanding customer service and proven reliability.

Claims Process and Customer Service Rankings

The claims process often reveals an insurer’s true worth, and Texas providers demonstrate clear differences in their customer service quality. When examining claims satisfaction metrics and customer service ratings, USAA consistently leads the pack, particularly for military members and their families.

GEICO stands out among major insurers for its superior claims interaction process, ranking highest in the 2020 J.D. Power study. State Farm maintains a strong reputation with fewer complaints than expected, given its large market presence. Progressive excels across multiple categories, including claims handling, billing, and policy options. Allstate performs above the regional average for customer satisfaction in Texas.

You’ll find these rankings particularly helpful when evaluating insurers, as they reflect real customer experiences during the critical moment of filing and processing claims.

Conclusion

Choosing the right car insurance provider in Texas requires looking beyond just the price. Strong coverage, reliable customer service, and available discounts all play a role in finding a policy that fits your needs. Some companies cater to budget-conscious drivers, while others offer premium plans with added benefits for extra peace of mind.